The 2025 Top 100 AI Champions in Global Mobility

What is PayLater, how it helps your employees and what to do if employees fail to repay

Page Sections:

Collecting Scheduled Installments

Minimizing The Need To Provide Payment Replacement

PayLater Feature and Action Guidelines

PayLater, a key Benivo feature, is very popular with both employers and employees. It reduces stress, saves the employee time, and ensures the employer offers equal opportunities to their talent, regardless of financial background. The average satisfaction score of PayLater is 9.8 on a scale of 0-10.

PayLater is an interest-free cash advance provided to your employees by Benivo in order for them to pay the sum of their first month’s rent (rent can also include administration fees from the landlord or estate agent, cleaning fees, or any other fees from the estate agent or landlord), accommodation deposit, and any other employer-approved expenses up to a pre-approved limit.

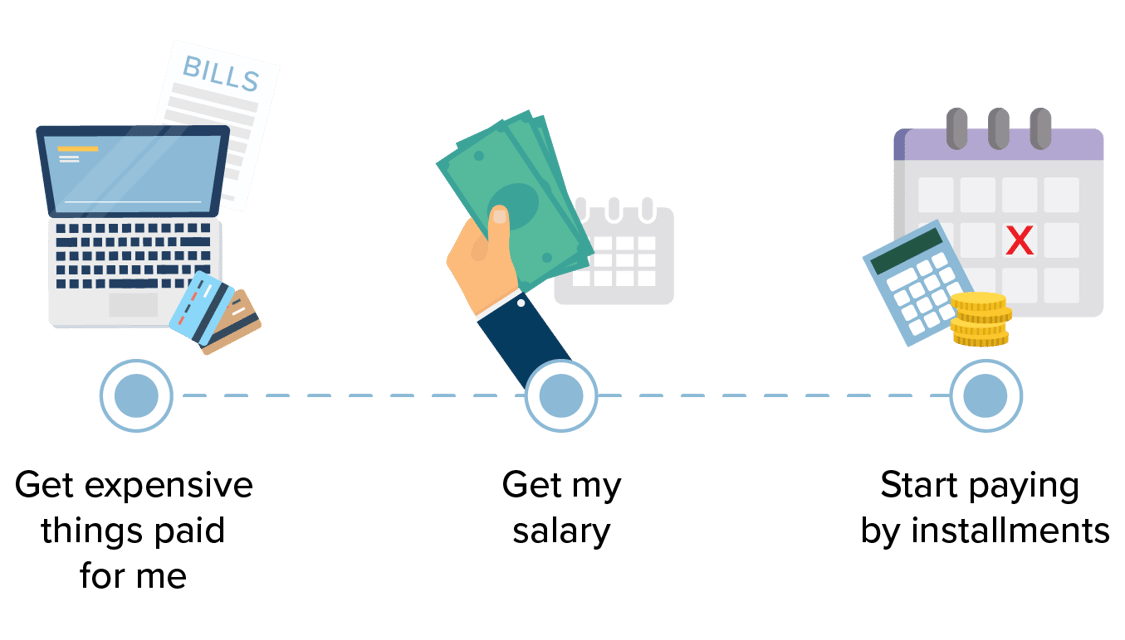

Feature overview

1. Benivo provides the employee with cash in advance to cover the first month’s rent, deposit and agency fees

2. The employee repays Benivo directly in up to 6 monthly installments after they received their first salary

3. If the employee does not pay an installment, the client provides a payment replacement

How it works for the employee

1. The employee selects an accommodation option to secure

2. The employee completes a PayLater request using their Benivo account:

3. Benivo transfers the requested funds to the employee or to the assigned accommodation provider

4. The employee pays back the amount in monthly installments starting on the first day of each month after they are paid**

*The number of installments would align with the length of stay (in months) up to a maximum of 6 months

**The repayment schedule is determined based on the indicated work start date which the employee provides upon registration. Employees starting work on or before the 9th will have their repayment schedule begin the following month. Employees starting work after the 9th will have their repayment schedule begin a month later. This setting cannot be altered.

What happens if an employee requests to postpone a scheduled installment?

Benivo will reach out to the employer to advise of the request as it requires employer approval. Any change to the repayment schedule will incur a charge of £150 to the employer.

What happens if Benivo cannot collect a scheduled installment?

Day 1 after payment failure:

Benivo will send daily reminders to the employee to request updated repayment details and attempt to resolve the issue.

Day 10 after payment failure:

If the employee does not respond to the outreach, Benivo will contact the client to flag that the employee is not responding and advise to follow the recommended steps detailed in the following section.

At any given moment, the client can access their Client Hub to view a full list of current live PayLater applications and how they are progressing.

Day 17 after payment failure:

If the employee has not paid the outstanding payment, Benivo will invoice the amount to due to the client.

Minimizing the need to provide payment replacement

In the last 4 years, Benivo has issued thousands of PayLater payments to employees. It’s extremely rare that employees do not pay back the amount they received.

Based on our experience with other clients, we have identified a few best practice solutions to ensure that, in the unlikely event of payment failure, the employer will reduce the need to provide a payment replacement.

Here are the steps we recommend you implement:

1. Upon employment termination or notice, notify Benivo immediately

Notify Benivo within 24 hours of an employee receiving or handing in their notice, for any reason. Benivo will then attempt to collect all outstanding funds immediately.

2. Deduct outstanding amounts from the payroll payment

As an employer, you can deduct the outstanding amount from the next payroll payment. This action is approved and signed by each employee opting in to use PayLater.

3. Establish the go-to person in the organisation upon a payment failure

These people will be the go-to contacts with whom Benivo will raise any questions with regard to employees. These contacts will also be the ones to update on any employees leaving the company. This will help you save time and increase the likelihood of collecting the payment while an action can still be taken.

4. Limit PayLater to permanent accommodation rentals only

Some clients found it helpful to limit the use of PayLater to permanent accommodation only, excluding temporary accommodation. While this reduces the value to the employee, it ensures they only use it once they make the decision to stay in the new location for a long period of time. You can change this at any time with a 10-day notice period, hence most clients find it helpful to start with the full coverage of both temporary and permanent accommodation and, if needed, change it at a later stage.

For any additional questions, please contact your Client Success Manager.

Last update Feb 14th 2019